UNDER THE SURFACE | 67 Pall Mall London’s first Fine Wine Trends Report

This month saw the release of the London Club’s first Fine Wine Trends Report, released to coincide with its 10th anniversary, and to chronicle the evolving tastes of Members over that time. It’s fair to say that it threw up some interesting results…

When exploring ways in which the Club should mark its tenth birthday in December this year, the London team pulled out all the stops. ‘Go big or go home’ was the original mantra of founder Grant Ashton, after all – and, with events from the likes of Krug, Opus One, Châteaux Rayas, Musar, Rauzan-Ségla and Canon peppering the autumn calendar, as well as a blowout Gala Dinner, it’s an approach that the team has been well and truly embracing.

But it was also felt that the Club should use its unique position to act as a barometer of the fine wine scene, turning inwards a little to take on board the habits, tastes and views of its Members over the last decade. The idea was to document how things have changed over the last decade, and consider the likely emerging trends over the next one – both for our own interest, but also as a benefit to the wider industry.

‘In the next ten years, I would

London Member

expect to see the Burgundisation

of all wine regions and styles,

right across the world,’

The resulting London Fine Wine Trends Report was based on extensive sales data from the Club, looking at spending patterns over the last 10 years, along with views solicited from the entire London membership via an email survey, followed by further qualitative research in the form of round-table discussions, all amplified by the expertise, experience and perspective of the Club’s core wine team. That data was then formed into a series of opinions, quotes and analysis around the most relevant topics.

So what did we learn from the exercise? Well, for the most part, London Members’ perspectives align closely with wider market sentiment, echoing concerns over en primeur fatigue, price inflation and the lionisation of ‘trophy’ wines – all factors driving the market’s recent downturn – while revealing a desire for connection over collection. Nearly 60% of Members said that increased prices of fine wine meant they were moderating their purchases, while 44% said they were buying less wine to lay down.

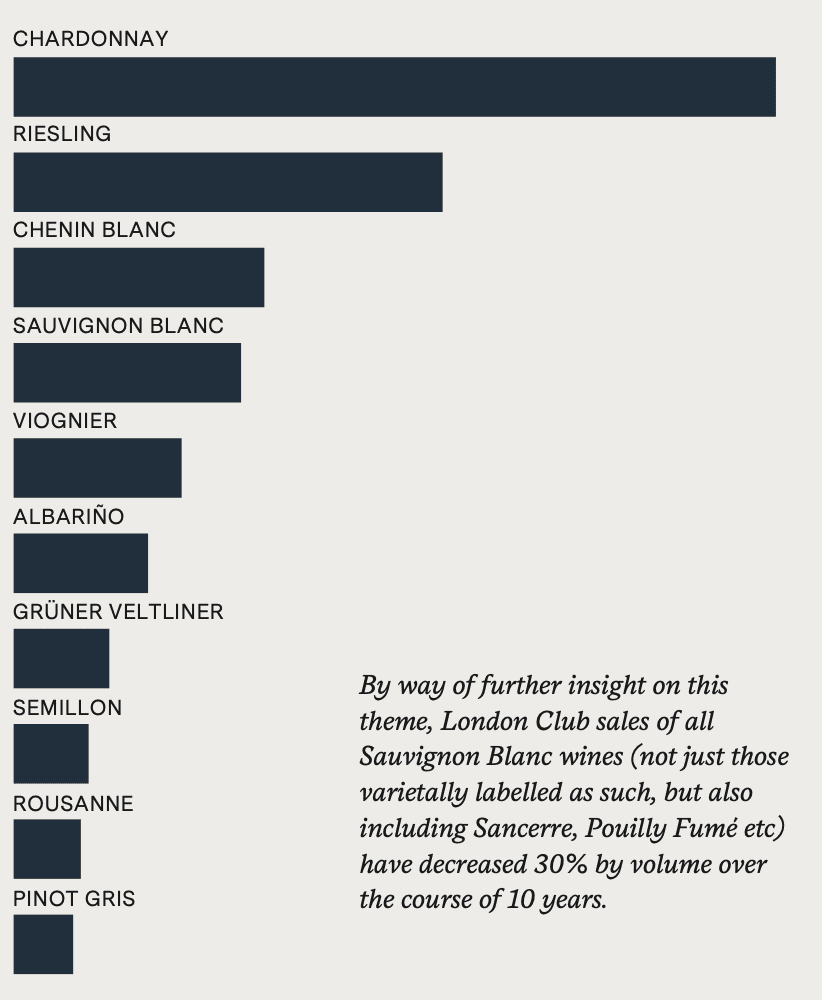

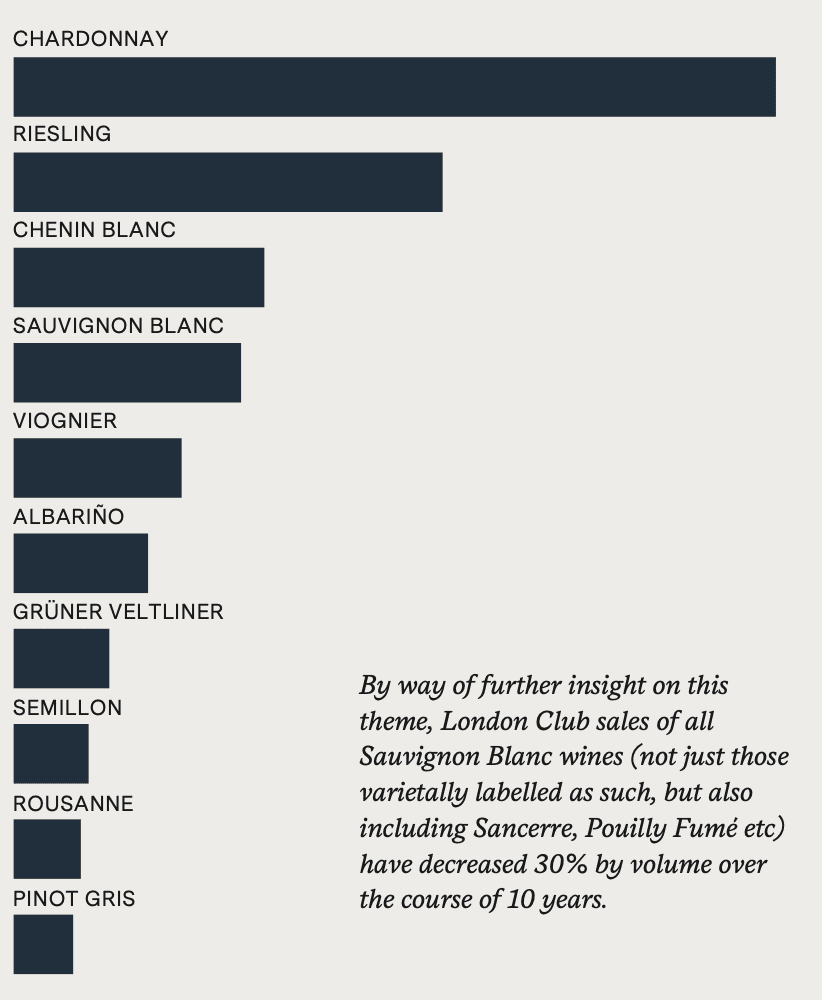

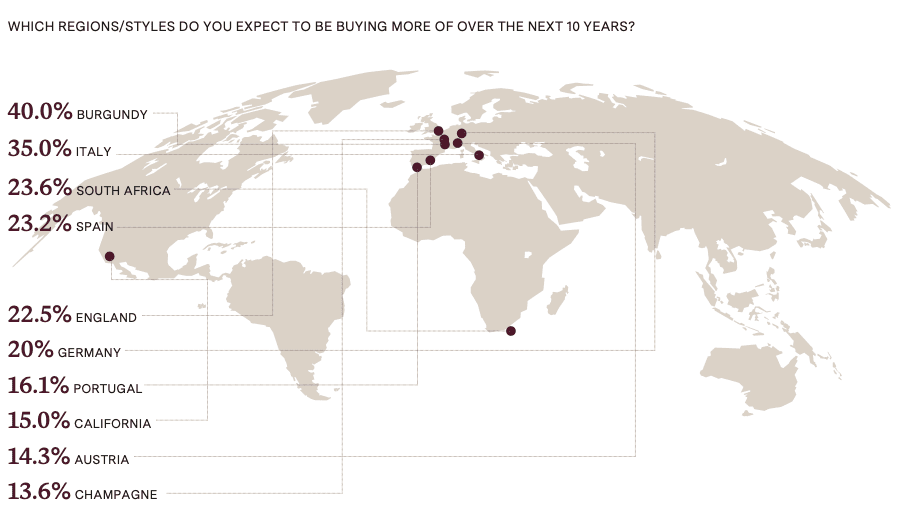

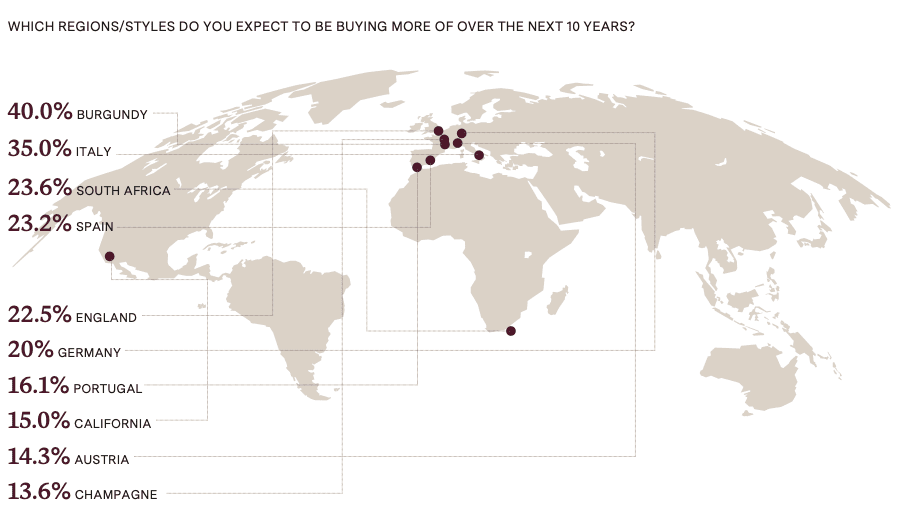

Despite market headwinds and future uncertainties, however, passion for fine wine burns as bright as ever. The report reveals an overwhelming 85% of respondents expanding their wine repertoire over the last ten years, exploring offerings from regions such as South Africa, Sicily and England with growing enthusiasm. Many have gravitated toward elegant, lighter reds from the likes of Germany and Piedmont in pursuit of quality and value beyond the traditional Burgundy and Bordeaux paradigm.

That said, Burgundy continues to dominate both sales and personal preference for most Members, with the elegance and sense of place offered by its wines translating into the growing popularity of wines from other regions that offer the same qualities. ‘In the next ten years, I would expect to see the Burgundisation of all wine regions and styles, right across the world,’ said one Member when asked to predict future trends.

While Members are increasingly mindful of alcohol levels, with many gravitating towards wines below 14% ABV, they have not been significantly swayed towards low-alcohol alternatives, with the majority sceptical of the quality of such offerings and embracing a ‘life is too short’ philosophy.

The issue of organic and biodynamic wines stimulated some heated debate. While London Members took notice of such credentials, there was a scepticism – even cynicism – as to how they are used. Many respondents indicated that whether a wine is organic or biodynamic has little to no influence on their purchasing decisions. Quality, producer reputation and personal taste were more important factors. That said, certifications such as organic or biodynamic were often viewed as a positive indicator of care and rigour in a producer’s approach, and hence an encouraging sign.

Among other topics to gain traction, the reticence of the younger generation to engage with wine was earmarked as cause for concern, though climate change was by far the most commonly mentioned topic on this front. Nearly half of all Members referenced it when asked to identify future threats, commonly citing the potential impact on the signature style of classic regions such as Burgundy, Bordeaux and Barolo. Many respondents expressed concern that higher temperatures, extreme weather events, lack of water and altered growing seasons could result in a loss of typicity, along with inconsistent quality and changes of style via higher alcohol levels and overly ripe flavours.

The motivation to purchase wines from classic regions before such stylistic change sets in was about the only positive sentiment expressed with regard to the En Primeur process. Many Members expressed frustration with the rising costs of En Primeur (notably in Bordeaux), which it was felt had become inflated to the point where it no longer makes sense to buy wines on release, as mature wines can often be found on the secondary market for a similar price or cheaper.

Rising prices across the wider market were also a concern, with many Members not only turning to alternative regions such as South Africa and Sicily, but also seeking out less heralded options within the renowned regions of Burgundy, Piedmont or Champagne (though it was felt this was more challenging in Bordeaux).

‘A lot of Members still want to drink Burgundy, but they ask for a less well-known producer or move down a bit in terms of the prestige of the appellation, from Meursault to Mercury or Puligny to St Aubin,’ said Head of Wine Operations London, Federico Moccia. ‘It’s the same in Champagne – everyone’s always looking for the new Ulysse Collin or Selosse, before it goes mainstream and becomes super expensive.’ Such an approach brought both risk and reward, however. ‘There’s a danger that fine wine is becoming too much about the rarest, the finest, the most expensive… We shouldn’t forget, wine is meant to be drunk – yet we talk about wines that we don’t drink, and we drink wines that we don’t talk about.’

Kathrine Larsen-Robert MS, 67 Pall Mall’s Head of Wine Europe, said of the exercise: ‘Contributing to this report has been enlightening. Most striking is the marked shift toward wines from a more diverse array of regions over the past decade, driven perhaps by an appetite for discovery and exceptional value. Members are increasingly embracing wines from emerging regions and lesser-known varietals.’

A trade-focused event was also held at the London Club to discuss some of the findings, while the report has been widely circulated to the fine wine press and trade, in the hope of better informing the market about the tastes and profile of our Members.

To read the full report, please see here.

Not a 67 Pall Mall Member? Sign up to receive a monthly edit of The Back Label by filling out your details below

WHAT

I’VE

LEARNED

Michael Brajkovich MW

MEET

THE

SOMM

Giacomo Apolloni

ON

THE

ROAD

Federico Moccia at Château Mouton-Rothschild